I am planning to order a Gustard R26 DAC from US. It costs $1650. What would be the customs duty that I would be expected to be paid ? Are there any other challenges? Pl. help. Thanks in advance for your help and guidance.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

customs duty

- Thread starter snath

- Start date

keith_correa

Well-Known Member

Search results for query: customs duty

I am planning to order a Gustard R26 DAC from US. It costs $1650. What would be the customs duty that I would be expected to be paid ? Are there any other challenges? Pl. help. Thanks in advance for your help and guid

Check this outI am planning to order a Gustard R26 DAC from US. It costs $1650. What would be the customs duty that I would be expected to be paid ? Are there any other challenges? Pl. help. Thanks in advance for your help and guidance.

GUSTARD - R26

Buy GUSTARD R26 R2R Decoder Native DSD DAC in India at Headphone Zone. Best Amps and DACs. Offers, Expert Advice, Reviews & Detailed Specs.

shankarcams

Active Member

$1650 plus say $100 courier is already 1.43 lakhs. Duty will be up to 60% depending on the officer.

Best to buy it in India if the price is what I is

Best to buy it in India if the price is what I is

srinisundar

Well-Known Member

$1650 plus say $100 courier is already 1.43 lakhs. Duty will be up to 60% depending on the officer.

Best to buy it in India if the price is what I is

Now you are bringing electronic goods in your name the landing duty is 77.28% with all extras addon. ( Unless otherwise you are taking a risk by putting only the values meagre amount in your invoice )

So better to bring in Company name with IEC and end up with less duty ( around 44% or as per the govt gazette for that particular goods ) if money transferred proof submitted for International transfer from that company.

So better to buy in India as suggested by @shankarcams .

keith_correa

Well-Known Member

77.28% duty????Now you are bringing electronic goods in your name the landing duty is 77.28% with all extras addon.

And what is "landed" duty?

srinisundar

Well-Known Member

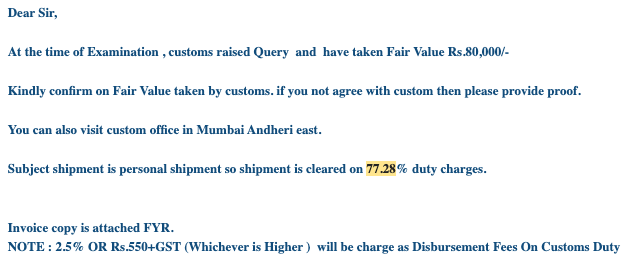

Landed duty before home delivered which also extra DHL/FEDex processing charges Plus ware house charges if there is delay in clearing the payment or acceptance of the customs duty evaluation or delay in submission of requested supporting documents. Email copy received from UPS for a speaker/amplifier for records..77.28% duty????

And what is "landed" duty?

keith_correa

Well-Known Member

This is beyond ridiculous.Landed duty before home delivered which also extra DHL/FEDex processing charges Plus ware house charges if there is delay in clearing the payment or acceptance of the customs duty evaluation or delay in submission of requested supporting documents. Email copy received from UPS for a speaker/amplifier for records..

View attachment 72338

Now that you mention it I did the Math and it works out to something like this:

Landed price = price + shipping + insurance

BCD @ 35% of landed price

GST @ 28% of landed price + BCD

Surcharge @ 10% of BCD

Daylight robbery charges by courier

Correct me if I'm incorrect.

srinisundar

Well-Known Member

Yes ofcourse not the robbery by courier , it is robbery by customs/Govt by pushing the courier to charge higher slab for direct consumers to avoid importing from abroad indirectly supporting the dealers/distributorsThis is beyond ridiculous.

Now that you mention it I did the Math and it works out to something like this:

Landed price = price + shipping + insurance

BCD @ 35% of landed price

GST @ 28% of landed price + BCD

Surcharge @ 10% of BCD

Daylight robbery charges by courier

Correct me if I'm incorrect.

Vivek Batra

Well-Known Member

Try going through this thread

www.hifivision.com

www.hifivision.com

Import formalities

Hi FMs This all started when I thought about importing something (read amplifier) from abroad to India, but had no idea how the import process and above all custom duty and clearance would work. This confusion and no concrete information available even on government sites made it more difficult...

muralimmreddy

Active Member

I am planning to order a Gustard R26 DAC from US. It costs $1650. What would be the customs duty that I would be expected to be paid ? Are there any other challenges? Pl. help. Thanks in advance for your help and guidance.

Gustard r26 is available now in hpz, if you still looking, and home audition is available as well.

I have x26, hoping to give it a try

GUSTARD - R26

Buy GUSTARD R26 R2R Decoder Native DSD DAC in India at Headphone Zone. Best Amps and DACs. Offers, Expert Advice, Reviews & Detailed Specs.

RaahulT

Active Member

All smaller goods imported for personal use through Post attracts appx 77.18% customs duty. Parcels containing arriving via Mumbai are being invariably retained & charged even if invoiced value is, say below 2k. Some sports goods items below $9/$10 was not charged but it arrived via Delhi. Also Parcel size does matter regd customs treatment.

Purchasing in India, if available, is safer & better bet.

Lately, HFZ rates are almost at par with Prices abroad+CIF.

Lower value items, its ok to import.

Purchasing in India, if available, is safer & better bet.

Lately, HFZ rates are almost at par with Prices abroad+CIF.

Lower value items, its ok to import.

RaahulT

Active Member

As per recent experience,All smaller goods imported for personal use through Post attracts appx 77.18% customs duty. Parcels containing arriving via Mumbai are being invariably retained & charged even if invoiced value is, say below 2k. Some sports goods items below $9/$10 was not charged but it arrived via Delhi. Also Parcel size does matter regd customs treatment.

Purchasing in India, if available, is safer & better bet.

Lately, HFZ rates are almost at par with Prices abroad+CIF.

Lower value items, its ok to import.

Total Charges incl Customs duty etc appear to be charged at 77.18% when Customs Deptt suspect underinvoicing and definitive assessment is not possible due plane packaging with no branding.

Charges@42% appx when definitive assessment is done. So I had to shell out 42% as per their fair assessment due to brand packaging for earphones which I didn't imagine would be held by them being a very small item.

Mumbai customs appears to be too much strict.

He is correct. I had to pay customs duty@42% approx on 2 to 3 occasions.As per recent experience,

Total Charges incl Customs duty etc appear to be charged at 77.18% when Customs Deptt suspect underinvoicing and definitive assessment is not possible due plane packaging with no branding.

Charges@42% appx when definitive assessment is done. So I had to shell out 42% as per their fair assessment due to brand packaging for earphones which I didn't imagine would be held by them being a very small item.

Mumbai customs appears to be too much strict.

You can avoid all of this if you have a friend who is willing to hand carry the R26 from Singapore.I am planning to order a Gustard R26 DAC from US. It costs $1650. What would be the customs duty that I would be expected to be paid ? Are there any other challenges? Pl. help. Thanks in advance for your help and guidance.

Does 42% duty also include gst or is it additional ?He is correct. I had to pay customs duty@42% approx on 2 to 3 occasions.

RaahulT

Active Member

As per recent experience,

Total Charges incl Customs duty etc appear to be charged at 77.18% when Customs Deptt suspect underinvoicing and definitive assessment is not possible due plane packaging with no branding.

Charges@42% appx when definitive assessment is done. So I had to shell out 42% as per their fair assessment due to brand packaging for earphones which I didn't imagine would be held by them being a very small item.

Mumbai customs appears to be too much strict.

Attachments

Hand carrying does not attract duty, even for used?You can avoid all of this if you have a friend who is willing to hand carry the R26 from Singapore.

India has drawn up a list of over 35 items that are being examined for a possible increase in the upcoming budget, scheduled to be announced on February 1.

Private jets, helicopters, high-end electronic items, plastic goods, jewellery..

cfo.economictimes.indiatimes.com

cfo.economictimes.indiatimes.com

Private jets, helicopters, high-end electronic items, plastic goods, jewellery..

Customs duty on 35 items may be hiked in Budget - ETCFO

Private jets, helicopters, high-end electronic items, plastic goods, jewellery, high-gloss paper and vitamins are among items that are on the list prepared by the government.

I recently ordered a Schiit Modi + dac from Schiit US. Shipping was through FedEx. last night fedex approached me with customs demand of INR 12000 of duty + GST . The invoice value is USD 129. That means I am paying 100 percent duty :-(India has drawn up a list of over 35 items that are being examined for a possible increase in the upcoming budget, scheduled to be announced on February 1.

Private jets, helicopters, high-end electronic items, plastic goods, jewellery..

Customs duty on 35 items may be hiked in Budget - ETCFO

Private jets, helicopters, high-end electronic items, plastic goods, jewellery, high-gloss paper and vitamins are among items that are on the list prepared by the government.cfo.economictimes.indiatimes.com

Get the Award Winning Diamond 12.3 Floorstanding Speakers on Special Offer

Similar threads

- Replies

- 19

- Views

- 4K

- Replies

- 10

- Views

- 2K