sandeeprawat

Active Member

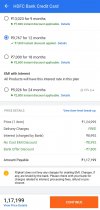

I have a GST registration but no income from business and filing zero return (and sometime penalty due to delay filing) I wonder if I should be able to claim creditNo, you just show the TV as part of your office expenditure & claim input GST, a big 28% saving right away.

Heck, you may even claim 40% depreciation (calculated through the written down value method) every year in your co's ITR.

Also, if @pauljoseph 's above idea works, then amazon business portal also has this 65 & 55 C9 with GST invoice and No Cost EMI option available thereby saving you a huge chunk.